How do you record it in QuickBooks when you give out inventory as freebies, samples, donations to charity, giveaways and the like?

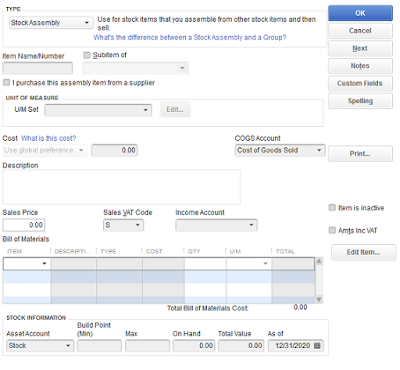

When you remove inventory (whether it's sold or given away) your inventory asset account is decremented. The other accounts involved in the transaction vary, depending on the method you use to track the freebie. Let's look at what happens when you sell an inventory item. QuickBooks makes the following postings (I'm ignoring VAT issues just to make this simple):

- Credits the Inventory Asset Account for the current average cost of the item (and reduces the Quantity Available for the item).

- Debits the Cost of Goods Sold account for the current average cost of the item.

- If the sales transaction is an Invoice, debits A/R for the sales price; if the sales transaction is a Sales Receipt, debits the bank account or the Undeposited Funds account (depending on your setup).

- Credits the sales price to the Income account linked to the item.

The same postings take place when you give away an inventory item, except the amounts of the postings involving the sales price is zero.

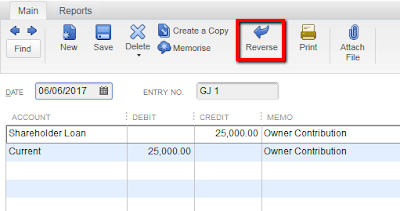

Using an Inventory Adjustment Transaction

An inventory adjustment is the fastest method if you don't need to track the details of the transaction in reports (such as the customer name). Here are the steps:

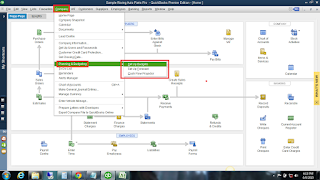

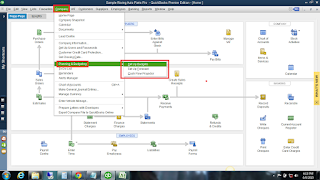

1. Choose Inventory Activities (from Home Page) | Adjust Quantity/Value on Hand.

2. In the Adjustment Account field, enter the appropriate account. If you're donating an inventory item to a charity, post the transaction to the charitable contribution expense. If you're sending a sample or a giveaway, use the Advertising or Marketing expense account.

3. Remove the item from inventory by entering the new quantity (current quantity minus one) in the New Qty column, or by entering -1 in the Qty Difference column.

4. If you're tracking classes, enter the appropriate class. QuickBooks debits the expense account and credits the inventory account, and also reduces the Quantity on Hand for the item.

Using a Sales Transaction

Use a sales transaction (either an Invoice or a Sales Receipt) if you want to track the customer and the reason for the freebie in reports. Use the following guidelines to create the transaction:

- Enter the item and quantity.

- Change the Amount column to 0.00.

- Enter the Class if you're tracking classes.

- Enter Memo text to describe the reason for the freebie (e.g. Promotion, or Contribution).

Note that there are two places to enter Memo text on a sales transaction: In the Description Field in the line item, and in the Memo field at the bottom of the transaction window. When you create reports that include the Memo column, the text in the Description field takes precedence over the text in the Memo field. If the Description field contains the item's description, that's the text that appears on reports, and for this purpose you should replace the text with the Memo text that describes the reason for the freebie so you get the reports you need.

If you're sending the freebie to an existing customer, use the customer in the transaction. If the item is going to someone who is not a customer, use a generic customer account (named Samples, Potential Customer, Donations, etc.) in the transaction. (It's not a good idea to fill your customer list with names that aren't really customers.)

For generic customers, enter the real name and address in the Customer Information block and select NO when QuickBooks asks if you want to change the address information for this generic customer. The information will remain on the sales transaction record and you can view it by opening the transaction. QuickBooks posts the transaction the same way it posts a normal, regular sale. Cost of Goods Sold is debited for the current average cost of the item, and the Inventory Asset account is credited for that value. In addition, the Quantity on Hand is decremented from the item's record. The amount posted to the income account linked to the item is Zero, and the amount posted to A/R (if you used an invoice) or Undeposited Funds/Bank Account (if you used a sales receipt) is zero.

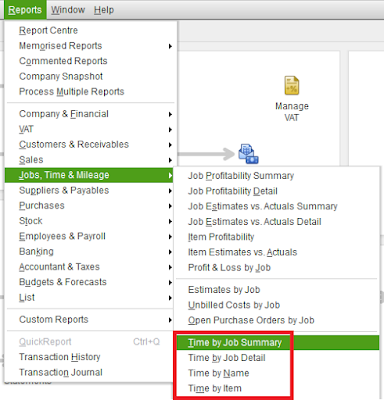

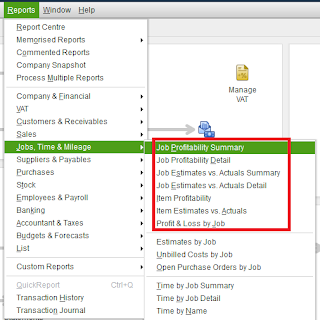

Creating Reports to Track Freebies

You can track details about the freebies you use in a sales transaction by creating reports that display the information you need. You need a report for promotional freebies and a separate report for contributions. Here are the steps:

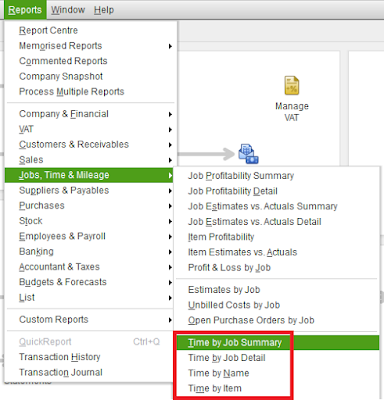

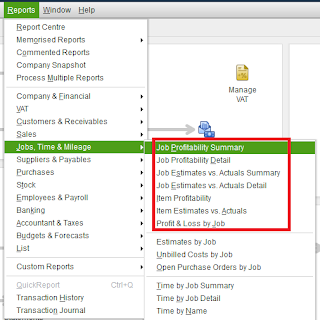

1. Choose Reports | Sales | Sales by Item Detail.

2. Choose Modify Report.

3. In the Filters tab configure the following filters:

- Amount. Select Equals (=) and enter 0.00.

- Item. Select All Inventory Items.

- Memo. Enter the memo text for this report (see the information about Memo text in the previous section).

4. In the Header/Footer tab change the name of the report to match its content (e.g. Promotion Freebies or Contribution Freebies.

5. Click OK and memorize the report so you don't have to go through this configuration work in the future.

For any questions, email us at albqbsolutions@gmail.com